Today, French investor La Française released its first coal exit policy on its website. It was among the last major French financial players to adopt such a policy. The new policy covers essential points, but remains largely perfectible.

1. What is new?

On October 5th, La Française published its new exclusion policy covering the coal sector on its website.

This policy includes the following measures:

- The exclusion of companies developing new coal mining or power plant projects

- The exclusion of companies deriving more than 25% of their revenues or electricity production from coal

- A commitment to completely phasing-out of coal by 2030 in the EU and OECD, and by 2040 in the rest of the world.

2. Our analysis: better late than never

Until now, , La Française, with €50 billion in assets under management, was one of the last two large French asset managers lacking a coal policy; the other being ODDO BHF AM. Thus, this policy fills a particularly flagrant gap.

It includes most of the critical elements of a good coal exit policy, but it is far from perfect.

For instance, La Française excludes most companies still planning to develop new coal mining or power plant projects around the world in 2020, but omits those planning new coal infrastructure. These are fewer in number but may have a significant role in opening new coal deposits or new coal-fired power plants. The case of the Galilee Basin in Australia is a good illustration of this: the construction of railroads could enable the exploitation of a real climate bomb that could indirectly emit as much greenhouse gas as Germany. Excluding these companies would follow La Française’s logic that “it is urgent not to support investments that would set CO2 emissions for decades to come”.

La Française also excludes companies that are the most exposed to the coal sector, using an exclusion threshold of 25% of revenues or electricity production from coal. But it omits large diversified players in the sector, such as BHP Billiton, Anglo American or State Development and Investment Corporation (SDIC), which are below this threshold and would only be excluded by an absolute and not a relative exclusion threshold. This absolute threshold is absent from the new policy.

Last, La Française sets the right objectives for a complete exit from the sector – in 2030 for Europe and the OECD and 2040 for the rest of the world – but fails to require remaining companies in the portfolio adopt an exit plan from the sector, following the same deadlines and based on the closure of coal assets and not their sale.

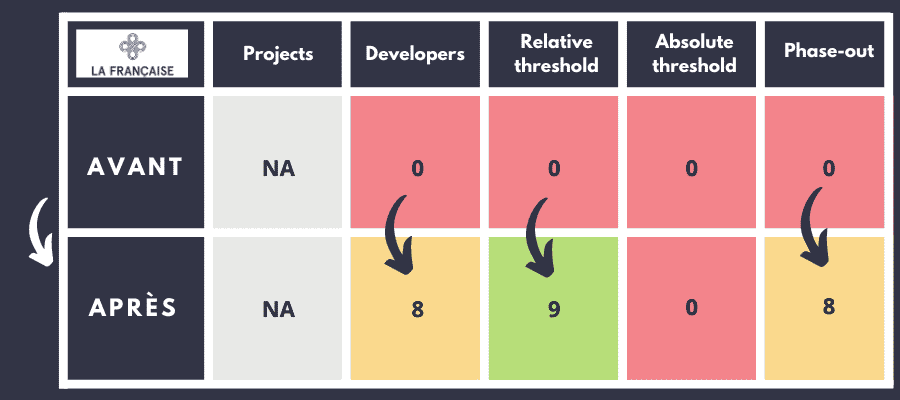

La Française thus goes from a score of 0 for the four criteria of the Coal Policy Tool to 8 for the developers’ criterion, 9 for the relative exclusion threshold, and 8 for the last criterion concerning the exit strategy.

La Française’s scores in the Coal Policy Tool

This table shows the scores of La Française’s coal policy on five criteria of the Coal Policy Tool.

These scores represent undeniable progress compared to the total absence of policy, but this new policy is still far from the best practices in the sector. For instance, Amundi excludes companies planning new coal infrastructure around the world and requires companies to have a plan for exiting the sector by 2030/2040. As for Crédit Mutuel AM, it excludes companies deriving more than 20% of their income/electricity production from coal, but also those producing more than 10Mt of coal per year or having an electricity production capacity of more than 5GW based on coal.

3. Our conclusion

La Française has made up for lost time, and still says that the “way towards a total coal exit will require regular updates of the exclusion policy”. It will, therefore, only need to incorporate the improvements mentioned earlier to join the leading group of financial institutions with a robust coal exit policy. La Française also indicates that it is considering “the gradual extension of the coal exclusion to other types of fossil fuels”, a step that is indeed unavoidable and increasingly urgent. To avoid falling to the bottom of the barrel, the sooner the better.