Scottish Widows adopted on November 9th its first very limited fossil policy. The old mutual insurance company, initially created in 1815, has become one of the biggest pension providers in the UK and is part of Lloyd’s banking group. It becomes the 14th financial player in the UK to have a coal policy, covered in the Coal Policy Tool. The policy, which includes wording on tar sands, remains highly incomplete on coal as it only covers coal mining and fails to prevent the expansion of the coal sector. The positive point is that this policy covers passive investments—a rare practice in the sector.

1. What’s new ?

Scottish Widows announced that it now excludes and divested from companies where 10% or more of their revenue is derived from thermal coal extraction or tar sands.

2. Our analysis: A very first step

a. On coal

The explanation of the approach taken by the insurer is interesting and the right one regarding the debate and perceived tension between engagement and divestment. In Scottish Widows press release, Maria Nazarova-Doyle, Head of Pension Investments at Scottish Widows, explains that “Our exclusions focus on companies we believe pose the most severe investment risk due to the nature of their businesses, which can’t be addressed through engagement.” While the general approach is the right one, implementation reveals major loopholes.

Only limiting coverage to coal mining considerably reduces the impact of this policy. Expanding the scope of this policy to also cover coal power is the logical next step for Scottish Widows, which should start by excluding all coal plant developers and the biggest coal power companies with more than 5 GW of installed capacity from coal.

As for coal mining, the 10% exclusion threshold is stringent but remains insufficient. Some companies below the 10% threshold are planning to expand their coal mining operations, such as Vale, while others are very diversified despite being among the most important coal producers globally, such as Anglo American. Moreover, depending on the database used, coal mining giants could remain in Scottish Widows’ portfolio. This is for example, the case of Glencore that generates more than 20% of its revenues from coal according to the GCEL but less than 5% according to Trucost.

The UK insurer’s coal policy does not commit to a deadline by which to phase-out from the coal sector completely, nor does it request companies still in its portfolio to do the same by 2030 in Europe/OECD and 2040 worldwide.

The scope of the policy, however, is positive. The insurer, which has 226 billion dollars of assets under management and nearly 6 million customers, will apply the policy to the funds it owns, and more importantly to index trackers it owns, which is very rare in the sector. Scottish Widows is also actively in discussions to engage and influence external passive fund managers to implement the exclusions in their pooled funds, which, if this translates into actual changes by these fund managers, could ultimately impact millions of pension savers since these funds are used by many schemes.

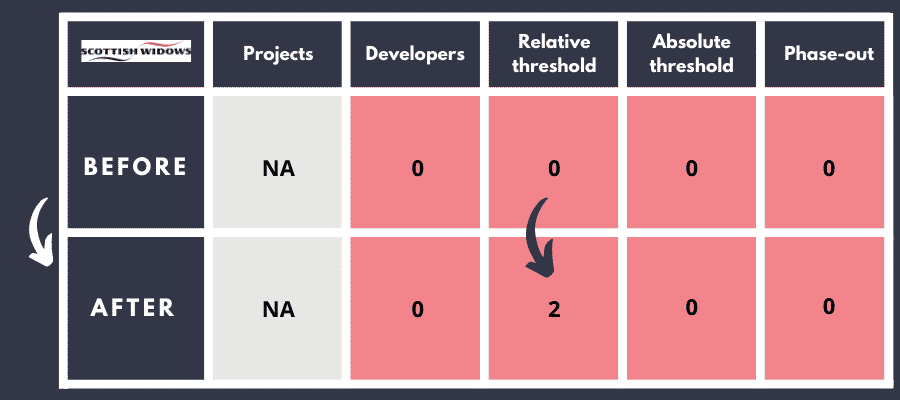

Scottish Widows’ scores in the Coal Policy Tool

This table shows the scores of Scottish Widows coal policy on 5 criteria of the Coal Policy Tool.

b. On oil & gas

The new measure taken by Scottish Widows on oil & gas is also very limited. While the 10% exclusion adopted is stringent, it lags behind Coutts, the UK asset manager, which adopted a 5% exclusion threshold for this sector. The two main shortcomings of the policy are the following ones:

- The metric used, revenues, is not the most pertinent since it will not cover oil and gas majors involved in this sector which generate a share of their revenues below this threshold. Therefore an approach using the reserves metric is more relevant and impactful.

- The tar sands sector is only a small subsector of the oil and gas sector. The new policy does not cover other subsectors such as the Arctic or shale oil and gas. The financial arm of the French State, the Caisse des Dépôts et Consignations (CDC), recently adopted a policy with a 10% threshold for the combined revenues from all these subsectors taken together.

The policy does not take any dynamic approach by excluding the developers of new oil and gas projects, or by committing to reducing the exclusion threshold over time, ending in a total phase-out by a specific deadline.

3. Our conclusion

Scottish Widows joins the small group of UK asset owners with such a policy but lags far behind Nest, the national pension funds system, which adopted a 20% exclusion threshold covering coal power and not only the coal mining sector. Nest also committed to fully exit the coal sector by 2030 and requires an exit plan by the same deadline for coal companies to remain in its portfolio. It lies even further from other international financial players such as KLP in Norway and its 5% and absolute exclusion thresholds, or the French CDC on oil and gas.

After this first step, Scottish Widows must quickly up its game and adopt new measures to directly adopt a high–quality coal exit policy, without further steps. Time is of the essence in the fight against climate change, and the investor will have to improve its policy on oil and gas significantly to align itself with the climate objectives of the Paris Agreement.