CIMB, Malaysia’s second largest bank by assets, announced earlier this week the adoption of its first coal policy. It joins the ranks of banks ending direct support to new coal mines and new coal plants worldwide and adopts a commitment to phase-out coal by 2040 from its portfolio. However, the details of this commitment will be published at a later stage. The new policy also fails to explicitly and systematically exclude a single coal company, not even those developing new coal projects.

1. What’s new

- The end of its direct support to new thermal coal mines and new coal plants, except for ongoing deals;

- The expectation for companies such as electricity utilities that rely on coal as a fuel source to provide a diversification strategy in order to reduce the share of coal in their power mix;

- A commitment to phase out coal from its portfolio by 2040. The details of this commitment will be published at a later stage.

2. Our analysis: a first step in the right direction

CIMB becomes the fourth Asian bank to stop direct support to new thermal coal mines and new coal plants, after the Singaporean banks UOB, OCBC and DBS, but contrary to UOB when it adopted its policy, it still allows ongoing deals to be finalized in the coming months and years. CIMB recently participated in the financing of the Jawa 9 & 10 coal units in Indonesia, with many other Asian banks. One of the existing potential ongoing commitments could be the Jawa 3 / Tanjung Jati A power station, for which CIMB was announced as financial adviser in March 2019. It was further announced in April earlier this year that the project could be financed through a bond issue. Many banks included this loophole in their coal policy in the past few years, but very few actually ended up financing these deals and preferred, under pressure from NGOs, to withdraw at one point in the process. This was the case for Credit Agricole, Societe Generale, BNP Paribas, Nedbank, Standard Chartered, OCBC and HSBC while only ING and DBS did finance some on going deals.

Regarding corporate finance, CIMB new coal policy falls short of adopting any clear exclusion criteria:

- The bank sets the “expectation” to see its clients in the coal sector adopt diversification strategies away from the dirty fossil fuel, but it fails to explicitly exclude them. In its coal policy, DBS uses the same approach but the bank does explicitly exclude coal power companies without diversification plans. Many European banks such as Crédit Agricole, BNP Paribas or UniCredit now blacklist all companies with coal development plans. According the latest financial data available, CIMB financed 9 coal plant developers to the tune of $3.5 bn between 2017 and September 2019.

- The bank does not exclude any company based on their relative or absolute exposure to coal. Several European banks have adopted a relative or absolute exposure threshold in the past few years. For example, Crédit Mutuel excludes companies deriving more than 20% of their revenues or power generation from coal as well as companies mining more than 10 Mt annually and companies with more than 5 GW of coal capacity.

CIMB commits in its announcement to phase out coal from its portfolio by 2040 but the details of this commitment will be announced at a later stage. It will be important for CIMB to apply this commitment to its general financing to coal companies, to send them a clear signal that coal must be phased-out by 2040 globally including in South East Asia, a deadline that has been adopted by a growing number of European banks recently, including Credit Agricole and BNP Paribas.

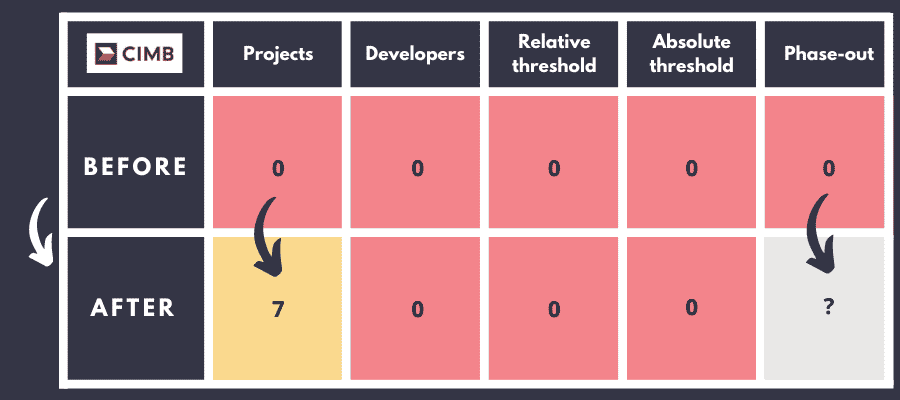

CIMB’s scores in the Coal Policy Tool

This table shows the scores of CIMB’s coal policy on 5 criteria of the Coal Policy Tool.

3. Our conclusion

CIMB has made a first step in the right direction by ending the direct financing of coal projects but it must now close the loophole by exiting its ongoing deals, and make sure its commitment to phase-out coal by 2040 applies to its general corporate finance. The Malaysian bank still has a long way to go to adopt a comprehensive coal policy and must quickly update its policy to exclude first all coal developers as well as the important players in the sector.