Early in December, Lloyd’s of London announced that it would ask its agents to stop insuring new coal mining, oil sands, and Arctic exploration projects as of 1 January 2022. The world’s largest insurance market had already adopted minimalist coal divestment measures but has so far refused to outlaw certain activities in its market. While this exit from coal is welcome, the measures announced are wholly insufficient to align the market, which in 2018 will account for 40% of the premiums linked to the energy sector with a 1.5°C trajectory.

1. What’s new

In its ESG report, Lloyd’s of London asks its agents to:

- No longer insure new coal plants and mines.

- No longer insure exploration in the Arctic.

- Not renew existing lines of insurance for coal plants and mines, oil sands projects, and Arctic exploration after January 1, 2030

- Not renew existing lines of insurance for companies that generate more than 30% of their revenues from the production or generation of electricity from coal, oil sands, or Arctic exploration activities after January 1, 2030

Lloyd’s of London intends to develop guidelines to aid agents operating in its market to apply its measures from January 1, 2022.

Regarding its investments, Lloyd’s of London announces that, from January 1, 2022, Lloyd’s market participants and the Lloyd’s Corporation will no longer invest in and, by end 2025, will divest from companies that generate more than 30% of their revenues from coal power generation or production, oil sands, or Arctic exploration activities.

2. Our analysis on coal

This is a huge leap forward on the part of the market, which has until now denied its responsibility in the choice of cover provided by the agents operating in its market. Lloyd’s was the last major insurance player in Western Europe to allow unreserved cover for new coal projects.

However, while Lloyd’s policy does not cover coal infrastructure projects such as railways or export terminals, its major weakness is that its exclusion of new coal mines and plants does not take effect until January 1, 2022. Pushing back the end of direct support for new coal projects by another year is unacceptable in light of the climate emergency, especially since such projects have been known to be incompatible with a 1.5ºC or even 2ºC trajectory since 2015.

In the same vein, the exclusion of companies is far too little and too late. Best practices, such as AXA’s policy, consist of immediately ending insurance coverage for companies planning new coal projects and companies with more than 30% exposure to coal. Excluding the latter companies only in 2030 will be far too late to ensure an exit from the sector by 2030 in OECD and European countries and by 2040 in the rest of the world.

Regarding investments, the announced criteria will apply to all agents and Lloyd’s, which is a real step forward, given that the policy adopted by Lloyd’s in 2018 only applied to the central fund, a tiny part of the assets. However, the 2018 criteria are still much more ambitious, with exclusions for the largest mining and coal-fired power producers. Lloyd’s should immediately review its policy to bring it at least in line with the 2018 criteria and add an exclusion for companies developing new coal projects. Moreover, it is essential to have a strategy for a total exit from coal.

3. Our analysis on oil and gas

While the criteria adopted for coal are insufficient, those for oil and gas are particularly deficient.

Lloyd’s does not specify which types of oil sands projects are excluded. Best practice implies excluding production projects but also transport projects. In the absence of details, only the former are likely to be covered. Concerning Arctic activities, Lloyd’s only excludes exploration and no production activities. Faced with melting ice and the urgent need to reduce annual oil and gas production by 4% and 3% between now and 2030, this is unacceptable.

In absolute terms, the threshold for excluding companies set at 30% of revenues is far too high, whether it is applied by 2022 for investments or 2030 for underwriting activities. In the case of the Arctic, since exploration is not expected to generate revenues, the impact of the measures adopted at the company level, both in terms of underwriting and investment, is highly uncertain.

Finally, Lloyd’s does not specify how it defines the Arctic.

Reclaim Finance is awaiting clarification from Lloyd’s.

4. Conclusion

The measures announced mark a welcome break with Lloyd’s firm refusal to bar certain activities from its market. However, they fall short of what is urgently required by the climate emergency and must be reviewed as soon as possible to ensure that all support for the expansion of coal, oil sands, and drilling in the Arctic is stopped. From 2021, Lloyd’s will also have to tackle the other fossil fuel sectors, starting with shale gas and oil.

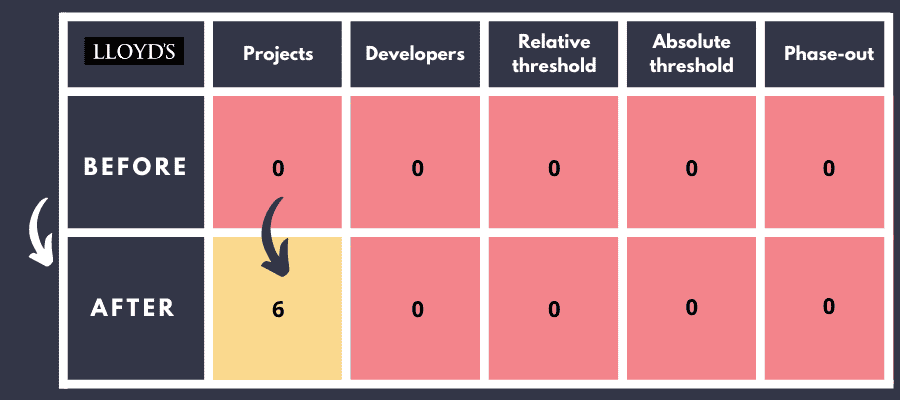

Scores of the Lloyd’s market in the Coal Policy Tool

This table shows the scores of the Lloyd’s market coal policy for each of the Coal Policy Tool criteria.

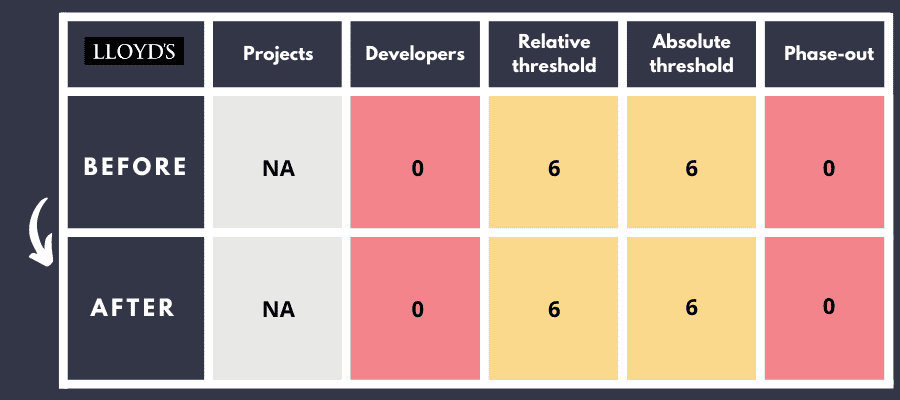

Scores of the Corporation of Lloyd’s in the Coal Policy Tool

This table shows the scores of the Corporation of Lloyd’s for each of the Coal Policy Tool criteria.