French insurer Groupama, which manages more than 100 billion euros in assets, recently updated its coal policy. Groupama has markedly improved its performance, notably by adopting an absolute exclusion criterion and a commitment to completely exit the sector within the correct timeframe. While some improvements are still possible, this is certainly the 17th robust exit policy from the sector adopted by French financial actors. It is now up to Groupama Asset Management, the group’s asset management subsidiary, to quickly align with this policy.

1. What’s new

Groupama already excluded companies in the sector planning to build new coal-fired power stations and those deriving more than 30% of their income or electricity production from thermal coal. The insurer will henceforth also exclude companies:

- Which are planning new coal mines and infrastructure;

- Which derive more than 20% of their income or electricity production from thermal coal;

- Which produce more than 20 Mt of thermal coal per year and those whose installed capacity of coal plants exceeds 10GW;

- However, exceptions remain possible.

In addition to these immediate exclusions, Groupama has committed to reduce these thresholds over time towards zero exposure within investment portfolios to thermal coal by 2030 at the latest in the countries of the European Union and the OECD and by 2040 in the rest of the world.

2. Our analysis: a big step foward

An important addition to this new version of the policy is the exclusion of developers of coal mining or infrastructure projects, companies who are still planning to expand this sector right when it needs to be rapidly wound down.

The change from an exclusion threshold from 30% to 20% follows the evolution of the selection criteria of the Global Coal Exit List, updated last November by our German partners at urgewald.

On the other hand, Groupama is missing an opportunity to immediately align with the thresholds of 10 MT and 5 GW retained by the GCEL and already adopted by financial actors such as Crédit Mutuel Assurances. The adoption of an exclusion criterion based on absolute coal production and the installed coal-fired capacity of a company is at any rate more than welcome, as it is a necessary criterion for covering some of the largest coal producers. with highly diversified activities.

The fact that Groupama uses the Global Coal Exit List as a benchmark for its analysis of companies in the sector is a very good thing since it is the most relevant database in this area. All these exclusions may, however, be subject to potential exceptions, when the analysis of Groupama Asset Management, the asset management arm of the Groupama group which manages most of its assets, differs from that of the GCEL. Groupama told Reclaim Finance that only two companies are currently subject to such an exception, which remains a low figure. However, the policy remains elusive on the handling of these exceptions.

In addition, Groupama indicates that it is “gradually withdrawing” from the securities of companies currently excluded from its portfolio, without being able to specify when this process will be completed. This could take several years, which is too long. However, the policy covers around 90% of the group’s own assets excluding sovereign bonds, which is a plus, but not the remaining 10% of assets invested in open funds managed by other asset managers.

Finally, although Groupama has committed to reducing its exposure to coal to zero by 2030/2040 by lowering its exclusion thresholds over time, it is missing an opportunity to request, explicitly and categorically, that the remaining companies in its portfolio adopti a plan to exit the sector within the same time frame, as Crédit Mutuel Assurances and Natixis Assurances are doing.

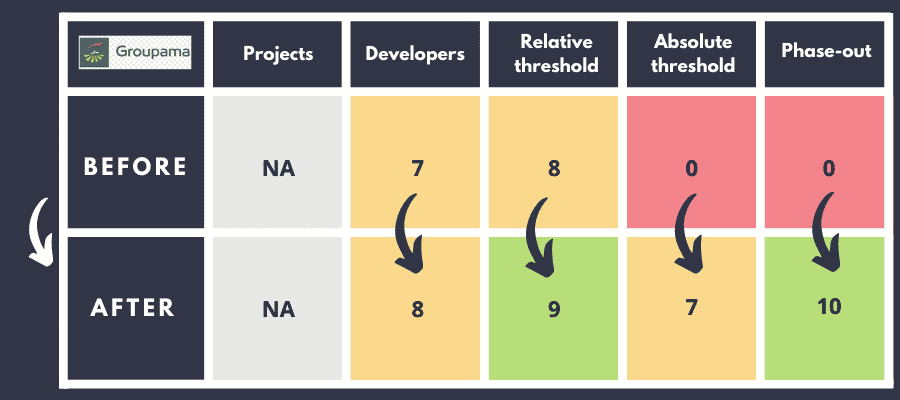

Groupama’s scores in the Coal Policy Tool

This table shows the scores of Groupama’s coal policy versus 5 criteria of the Coal Policy Tool

3. Our Conclusion

Groupama’s new policy incorporates all the essential elements of a robust coal phase-out policy. It thus becomes the 17th French financial institution to adopt such a policy, and the 8th insurer. All that remains for Groupama to do is to rapidly lower its absolute exclusion thresholds to follow the evolution of the GCEL; to quickly divest the excluded securities in the portfolio; to ensure that the policy is applied to open funds managed by other asset managers; and to ask the remaining companies to adopt a mandatory plan to exit the coal sector by the right deadlines. Above all, Groupama Asset Management will have to follow the example of its parent company and align itself as quickly as possible with its policy.

The list of French financial actors with a substantially incomplete coal policy is shrinking, and all eyes turn to SMA, who is still lagging behind in the sector. Finally, it is important to remember that coal is only the first step in a successful climate strategy, and that Groupama must now begin work on the development of a good sectoral policy on oil and gas.